By Bernstein Private Wealth Management

Einstein famously said, “Energy cannot be created or destroyed, it can only be changed from one form to another.” For charitably-inclined business sellers, Einstein’s theory takes on a whole new meaning—one that can help them save taxes on the proceeds from a sale.

How? Exiting business owners often donate some of their windfall to cherished charities once the sale transaction is complete. While that may make sense intuitively, it is not as tax efficient as it could be. Here’s a simple example.

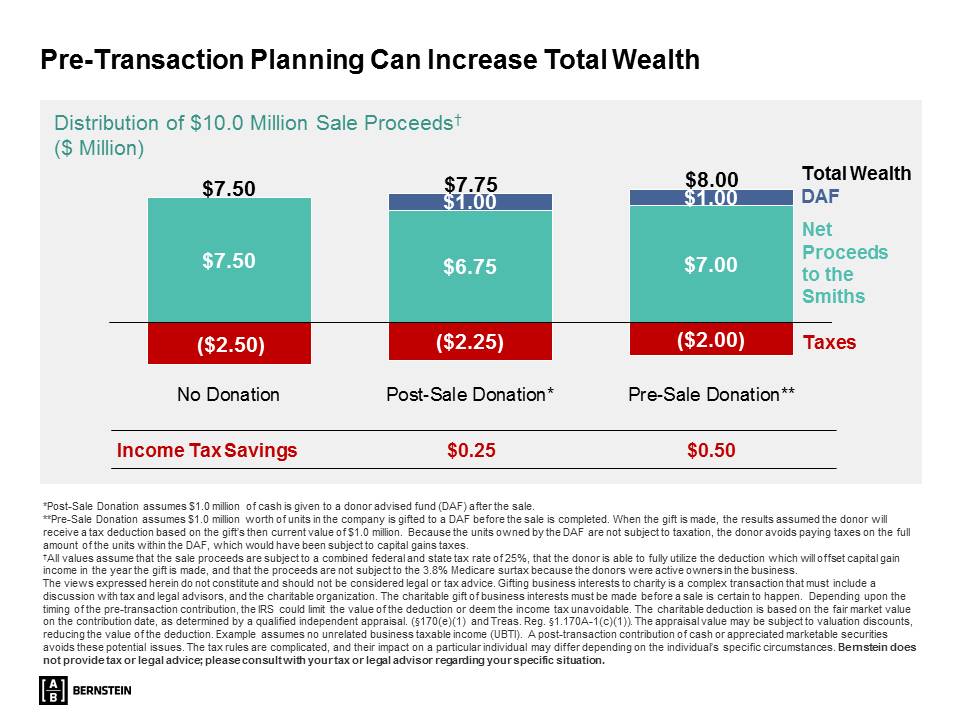

Let’s say Mr. and Mrs. Smith sell their business for $10 million after all fees but before taxes. They get a wonderful payday that should set them up financially for the rest of their lives: After paying a combined federal and state capital gains tax rate of 25%, they will have $7.50 million, as the left column in the Display shows.[1]

With the proceeds certain to support their lifestyle going forward, the Smiths decide to give $1.00 million to their Donor Advised Fund (DAF). If they wait until after the deal closes, they would be entitled to an income tax charitable deduction equal to the donation, which would save them $250,000 in income taxes. As a result, the $1.00 million donation would increase their Total Wealth (the Smith’s net proceeds plus the amount held in the DAF) to $7.75 million as the middle column of the Display shows.

A Genius-Level Approach

While the Smiths welcome the idea, they are open to taking it a step further. If the Smiths donate $1.00 million worth of units of the business to the DAF before the sale instead of after, it could create even more wealth.

By gifting units of the company presale, the Smiths would receive an income tax charitable deduction equal to the gift. And because those units are now owned by the DAF—which is tax exempt—they would avoid taxation all together. This dual benefit of receiving a tax deduction and avoiding taxes on the units given to the DAF saves the Smiths $500,000 in income taxes and increases the Total Wealth to $8.00 million as the right column in the Display shows.

There’s no magic or alchemy here. Transferring money to the DAF prior to sale creates the additional $500,000 because the Smiths get a charitable deduction and avoid capital gains tax on the shares given.

Putting it all together for Auto Dealers

Prioritizing what truly matters can be eye-opening for anyone but it’s especially vital for auto dealers contemplating an exit strategy. An auto dealer who sees how a potential sale can fulfill personal charitable goals – as well as financial goals – is much likelier to get a better outcome.

The views expressed herein do not constitute and should not be considered legal or tax advice. Gifting business interests to charity is a complex transaction that must include a discussion with tax and legal advisors, and the charitable organization. The charitable gift of business interests must be made before a sale is certain to happen. Depending upon the timing of the pre-transaction contribution, the IRS could limit the value of the deduction or deem the income tax unavoidable. The charitable deduction is based on the fair market value on the contribution date, as determined by a qualified independent appraisal (§170(e)(1) and Treas. Reg. §1.170A-1(c)(1)). The appraisal value may be subject to valuation discounts, reducing the value of the deduction. Example assumes no unrelated business taxable income (UBTI). A post-transaction contribution of cash or appreciated marketable securities avoids these potential issues. The tax rules are complicated, and their impact on a particular individual may differ depending on the individual’s specific circumstances. Bernstein does not provide tax or legal advice; please consult with your legal or tax advisor regarding your specific situation.

Read more about Bernstein Private Wealth Management www.bernstein.com or contact principal Dan Gavin at dan.gavin@bernstein.com.

[1] As active owners, the Smiths are not subject to the Medicare surtax of 3.8%.